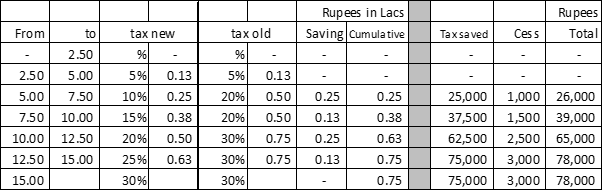

Budget 2020 brought in new lower personal tax rates which one has an option to choose from. However, while doing so, you forgo most deductions from personal income which are currently available.

Above table compares difference in tax as per old and new rates and tax saved thereon (presuming Nil deduction). Maximum tax saved under new tax rates is 75,000 (78K with cess)

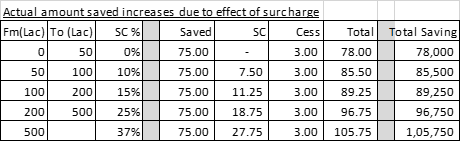

For those with income levels of 50 Lacs and above, the amount saved under new rates will be yet higher due to the effect of the surcharge as shown in the above table.

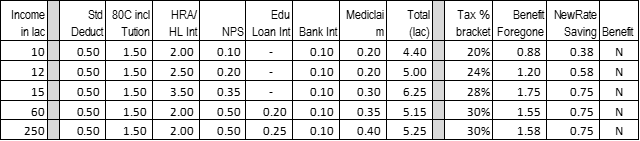

Deductions Foregone: Under the new tax option, only the employer’s contribution to NPS and 80JJAA are allowed. Other deductions shall NOT be allowed: eg, Standard Deduction; HRA; LTA; Interest on Home Loan; u/s 80C (LIC, PF, PPF); NPS; Medical insurance; Donations; Bank interest; Interest on Education Loan; Expense for disability or specified disease,… all these deductions and benefits will go away.

Having understood amount saved under new tax rates, we need to compare it with amount of benefit foregone and accordingly exercise the option available. Following examples will help in this and are given as indicative. Presumption of savings is based on what normally is done by salary earners at levels mentioned below. This is a general analysis and may need to be tweaked to your specifications:

As we see, mainly due to the benefit for rent paid under HRA or Home Loan Interest for self occupied house property, the option of new tax rates may not be beneficial. However, this may not be true for all and an individual analysis of the benefits foregone with tax saved should be undertaken by everyone since these calculations will be different for every person